Equipment Financing For Startups

Understanding MCA funding Costs and Charges

Quick way to attain working capital (up to a $1,000,000) to keep your business moving forward.

What is Equipment Finance for Startup Business

Partnering with a equipment financing companies is a top-notch solution to secure funding for your equipment financing for startups. When you’re prepared to begin but uncertain about the right partner, consider reaching out to Exquisite Capital Group! Leveraging our extensive vendor network and personalized approach, we ensure your business receives timely funding to fulfill its needs. Transform your startup dreams into reality with a merchant cash advance Loan for startups! Equipment lease financing typically involves two primary methods of funding for businesses : equipment loans and equipment lease. Equipment loans are secured loans where the borrower uses the funds to buy the equipment, and the purchased equipment serves as collateral for the loan. As the loan is repaid in full, ownership of the equipment transfers entirely to the business, unencumbered by any liens or claims.

Starting a new business is an exciting venture, but it often comes with significant financial challenges. One of the primary hurdles for startups is securing the necessary equipment to operate effectively. Fortunately, equipment financing for startup businesses offers a viable solution. In this guide, we’ll explore the best equipment financing companies for startups, various financing options, and tips for those with bad credit.

Equipment financing refers to loans or leases that allow businesses to acquire equipment without paying the full amount upfront. This financing is particularly beneficial for startups, as it enables them to preserve their capital for other essential expenses.

Why Exquisite Capital Group For fast equipment financing

Quick and Convenient Access to Capital:

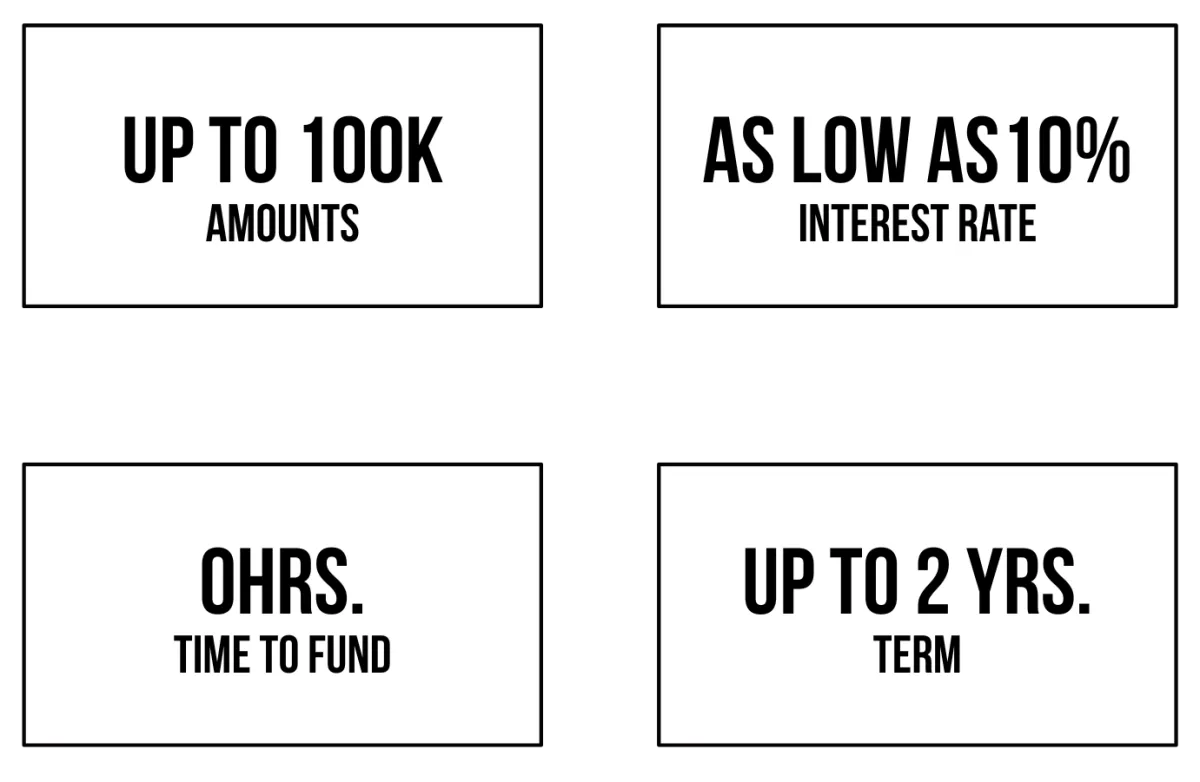

Competitive Terms and Rates

Support for Business Growth

Expert Guidance and Customer Support

Equipment Financing for Startup Business

What you’ll need to do to qualify for startup equipment financing :

600 minimum credit score

$100,000 in yearly revenue

11+ months in business

Documentation Needed for Equipment Loans for Startup

Basic details about you and your business

Bank statements for past 3 months

Business is in good standing

Benefits of Equipment Lease Financing for Startup Business With Dawn Financial

Quick and Convenient Access to Capital: Our Lease equipment for startups may help you stay liquid while still getting the equipment you need.

Flexible Financing Options: They can be customized to meet the specific needs of each client.

Support for Business Growth: If you’re tight on working capital, this may help you get the best equipment financing companies for startups you need to keep the business running.

Equipment Loans for Bad Credit

Securing equipment financing with bad credit can be challenging, but it’s not impossible. Many lenders understand that startups may not have an extensive credit history. Here are a few options for startups facing credit challenges:

Alternative Lenders: Look for lenders who specialize in equipment loans for bad credit. These institutions often have more flexible criteria and can help you secure financing despite your credit score.

Personal Guarantees: Some lenders may consider a personal guarantee from the business owner, allowing access to funds even with poor credit history.

Used Equipment Financing

For startups looking to save money, used equipment financing is a smart choice. Financing used equipment can significantly lower your upfront costs and still provide high-quality tools for your business. Many financing companies offer favorable terms for used equipment, making it an attractive option.

Equipment Financing with No Money Down

One of the most appealing aspects of equipment financing for startups is the possibility of obtaining funding with no money down. Many lenders offer this option, allowing businesses to acquire necessary equipment without an initial cash outlay. This can be crucial for startups that need to allocate their resources efficiently.

Easy Equipment Financing Solutions

Startups should look for easy equipment financing options that simplify the borrowing process. Many companies offer online applications, quick approvals, and straightforward terms, making it easier for new businesses to get the funding they need without unnecessary hurdles.

Copyrights 2025 | Exquisite Capital Group™ | Terms & Conditions