unsecured lines of credit With exquisite

Understanding MCA funding Costs and Charges

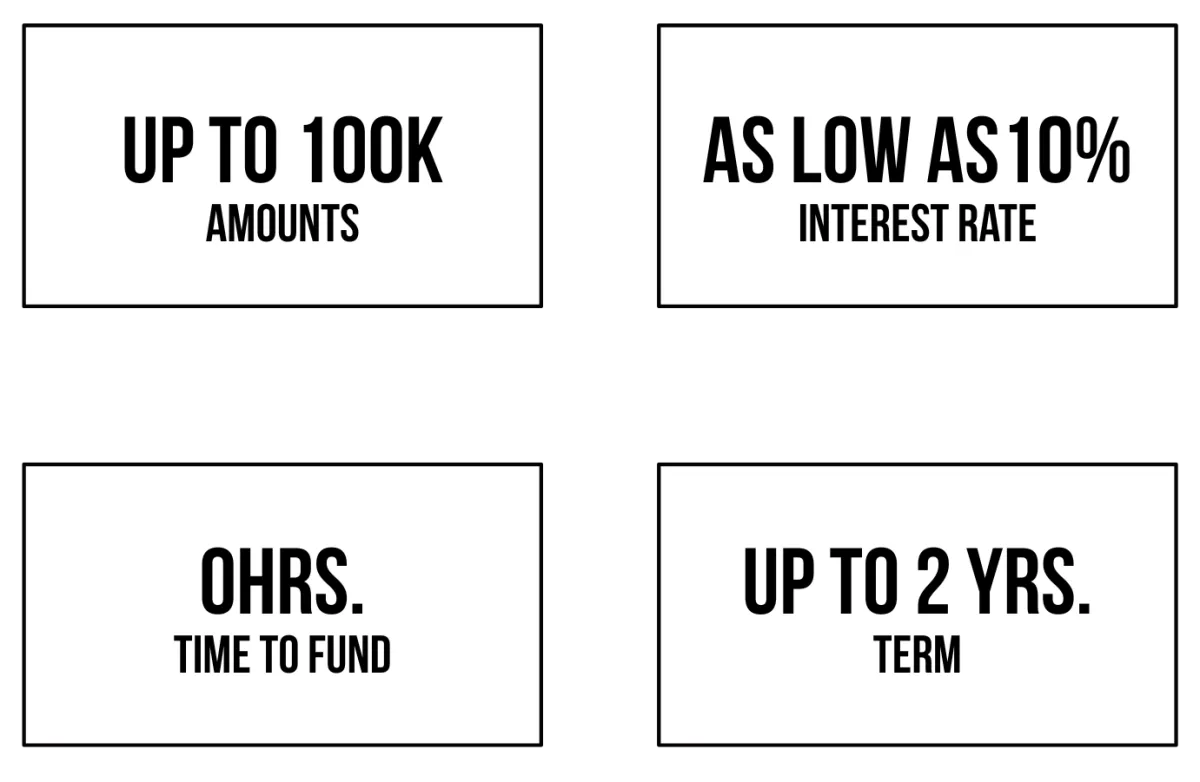

Quick way to attain working capital (up to a $1,000,000) to keep your business moving forward.

What Is unsecured lines of credit?

A unsecured line of credit (LOC) is a flexible financial arrangement that allows an individual or business to borrow money up to a predetermined credit limit. It is a form of revolving credit, where borrowers can access funds as needed and only pay interest on the amount borrowed. Unlike a traditional term loan, where you receive a lump sum upfront and repay it over a fixed period, a line of credit provides ongoing access to funds that can be borrowed, repaid, and borrowed again as long as the credit limit is not exceeded.

Why Exquisite Capital Group For fast equipment financing

Quick and Convenient Access to Capital:

Competitive Terms and Rates

Support for Business Growth

Expert Guidance and Customer Support

Pre-qualifications for business lines of credit unsecured

What you’ll need to do to qualify for a business lines of credit unsecured:

550+ credit score

$80,000 in yearly revenue

6+ months in business

Documentation Needed For Line of Credit

Basic details about you and your business

Bank statements for past 3 months

Business is in good standing

The Advantages of a business lines of credit unsecured

Flexible Access to Funds: unsecured lines of credit provide flexibility in accessing funds. You can draw funds as needed, making it a convenient option for managing cash flow fluctuations and covering unexpected expenses.

Working Capital Management: A business credit lines unsecured can help you effectively manage working capital by providing access to short term Loans for day-to-day operations, payroll, inventory, and other operational expenses.

Interest on Utilized Amount: You only pay interest on the amount of credit you use, not on the entire credit line.

Quick Access to Capital: Once approved, you can access funds relatively quickly, which can be crucial in addressing time-sensitive business capital loans.

Copyrights 2025 | Exquisite Capital Group™ | Terms & Conditions