Grow Your Business With mCA loans

Understanding MCA funding Costs and Charges

Quick way to attain working capital (up to a $1,000,000) to keep your business moving forward.

What is a Merchant Cash Advance?

A Merchant Cash Advance Loans (MCA Loans) provides businesses with quick access to working capital based on anticipated credit card sales or other receivables. This alternative financing option allows businesses to receive a lump sum of cash upfront, which is then paid back through a percentage of future sales, offering flexibility in repayment aligned with business revenue.

Eligibility Requirements

To qualify for an MCA, businesses must meet specific criteria, including the acceptance of credit card payments or possession of other receivables.

Significant Advantages of Merchant Cash Advance with merchant cash advance providers

Simple Application Process

No Collateral Required

Credit Score Flexibility

Application Process at Exquisite Capital Group

Applying for an MCA at Exquisite Capital Group is simple and efficient. You can fill out the application online in just a few minutes. We offer cash advance amounts starting from $5,000 up to $500,000.

How Does a Merchant Cash Advance Work?

Small businesses often face significant challenges when seeking funding, especially during critical times. Traditional lenders, such as banks, typically have lengthy approval processes, and many business credit cards require good to excellent credit scores.

A viable solution to this problem is a merchant cash advance (MCA). Unlike traditional financing, an MCA evaluates a business’s past debit and credit card sales to provide an advance based on anticipated future sales. This process allows for quicker funding compared to conventional methods.

If approved for an MCA, repayments are usually deducted directly from your merchant or bank account, either daily or weekly. Some MCA Loans also adjust the payment amount based on your sales; if sales are low, your payments decrease, which can alleviate cash flow pressures.

It’s crucial to assess your cash flow consistency and ensure that you have sufficient funds in your merchant account to cover the repayment amounts as they come due.

What You Need to Know About Merchant Cash Advances (mCA Loans)

Merchant Cash Advance Pros

One of the primary benefits of merchant cash advances (MCAs) is the rapid access to funds. Many lenders can provide a lump sum within 48 to 72 hours. Unlike traditional loans, personal and business credit scores are less of an obstacle.

MCAs focus more on your credit card sales and non-invoice revenue rather than requiring high credit scores. This makes them more accessible for businesses that may struggle to qualify for conventional loans.

Another advantage is the minimal restrictions on how you can use the funds. This allows you to allocate the advance towards whatever needs your business has without external constraints. Additionally, you won’t need to provide collateral beyond your future credit card receipts, and many providers offer flexible repayment options.

Merchant Cash Advance Cons

Merchant cash advances often come with high costs. A low factor rate might equate to an annual percentage rate (APR) of around 35%, while a high factor rate can result in an APR exceeding 350%.

Additionally, since these advances are not classified as loans and do not report payment histories to business credit bureaus, they do not contribute to building business credit. With daily repayment schedules being common, poorly managed merchant cash advances can quickly strain cash flow.

Merchant Cash Advance Terms and Features

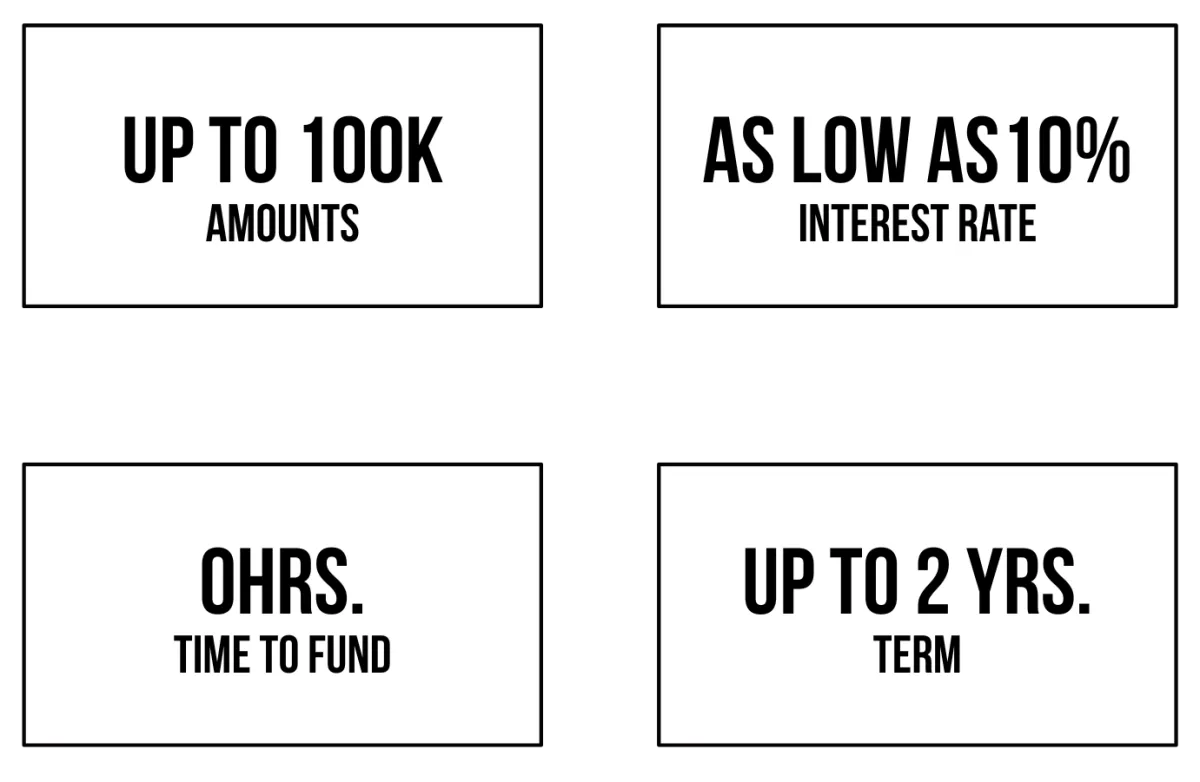

Obtaining a merchant cash advance (MCA) is a fast and straightforward process, with applications typically taking little time to complete. You could even receive same-day approval and access your funds within one or two days.

This quick approval means you can secure cash more rapidly than through other financing options, such as short-term or long-term loans. Additionally, MCAs generally do not require good business credit or collateral, as they are primarily based on your business’s cash flow rather than your credit history or score.

Key features of a merchant cash advance include:

Advance Amount: The amount you can receive typically ranges from $2,500 to $1 million, with most advances falling between $5,000 and $500,000.

Factor Rate: The cost of the advance is expressed as a factor rate, which can be as low as 1.09 but may exceed 1.5 for larger amounts.

Payment Frequency: Instead of monthly payments, MCA Loans require daily or weekly payments, often deducted automatically as a percentage of your sales.

Repayment Period: There is usually no fixed repayment term, as payments are based on sales. However, this financing is considered short-term, with repayment expected within three months to two years.

While MCA Loans are easy and quick to obtain, it’s essential to consider the high costs involved. You may end up paying up to 50% of the principal amount, and the fixed payment amount does not decrease over time as it would with traditional loans. Additionally, there may be penalties for early repayment, resulting in a higher APR.

How to Apply for a Merchant Cash Advance

Qualifying for a merchant cash advance (MCA) is often the simplest aspect of the process. Unlike traditional small business loans, applicants do not need to have been in business for 2-3 years. Instead, the volume and frequency of credit card payments are more critical than the business’s credit profile. This makes eligibility generally more flexible, allowing businesses with poor credit to qualify if they demonstrate strong sales figures.

Most merchant cash advance lenders, facilitate & online applications, further streamlining the already quick process for business owners.

To apply, you will typically need to provide:

3-6 months of business bank account statements

Merchant account or credit card processing statements

Basic information about your business

While the cash advance provider may check personal or business credit, the primary focus will be on your bank and merchant account statements. However, having good credit may improve your chances of securing better terms.

How a merchant cash advance lenders Can Uplift Your Business

While the costs of a merchant cash advance (MCA Loans) are generally higher than those of traditional bank loans, they come with several notable advantages:

The application process is typically fast and straightforward.

You receive quick responses and can access funds rapidly if approved.

Exceptional credit is not a prerequisite for qualification.

An MCA can be beneficial when your business needs to quickly invest additional capital to seize an opportunity that promises a good return on investment (ROI).

However, while an merchant cash advance for startups can provide quick access to capital, it may also jeopardize your cash flow if not managed carefully. Many businesses with weaker credit profiles find MCAs attractive, often using them to address short-term cash flow issues. A strategic use of an MCA could be to fund time-sensitive opportunities, such as purchasing inventory that can quickly generate additional ROI.

The most successful businesses in utilizing an MCA are those that direct funds toward activities that yield ROI, remain conscious of associated costs, and comprehend how those costs relate to potential gains. If this resonates with your situation, a merchant cash advance could be a viable option.

That said, due to their higher costs, MCA Loans are become very expensive, especially if you’re relying on them to resolve financial crises. It’s advisable to avoid becoming dependent on merchant cash advances, as their costs can complicate future cash flow management.

Alternatives to Merchant Cash Advances (MCA loans)

A merchant cash advance is simply one of several business funding options available to small business borrowers — even with a less-than-perfect credit profile. Here are some of those other options:

Online small business loans

Many online lenders offer both short- and long-term business loans that can meet the needs of a small business. Each online business loan program will have different eligibility requirements. The goal is to find a loans that meets your business needs, and is also a match with your profile.

Business cash advance

Different from a merchant cash advance in that it is based on your cash flow, the business cash advance often has a fixed payment (still potentially daily or weekly depending on the lender), and may offer somewhat lower costs than a typical merchant cash advance.

Factoring

Factoring is not a small business loan either. Instead the business sells outstanding invoices at a discount. It provides cash now rather than waiting for your customers to pay their invoices, and it is a viable way to access short-term capital (provided your customers pay by invoice).

Accounts receivable financing

Unlike factoring, AR financing is a loan secured by the value of your receivables. The lender will typically report your loan payment history to the appropriate business credit bureaus, meaning your good credit practices will help improve your business credit profile in addition to providing you with access to borrowed capital.

Business credit cards

Most business credit cards offer a line of credit you can use for short-term financing. Minimum payments are often low, but interest rates can be high, though not as high as some MCA loans. A few business credit cards feature 0% intro APRs, which can make them an affordable option if you need to borrow funds for a short period of time.

Merchant Cash Advance Lenders

What you’ll need to do to qualify for a MCA Loans :

Bank statement for past 3 months

5+ plus months in business

Business in good standing

450+ credit score

Requirements for Applying MCA Loans

Basic details about you and your business

business in good standing

Last 3 months of statement

Florida Merchant Cash Advance

Unlocking Business Advantages with a Merchant Cash Advance Bad Credit or mca servicing

Quick Access to Capital: Decisions as fast as 3hrs

Simple Application Process: Basic information of you and your business along with the last 3 months of bank statements

No Collateral Required: MCAs(Merchant Cash Advance ) loans are unsecured, so you don’t need to put up collateral such as assets, or property to secure the funding.

Copyrights 2025 | Exquisite Capital Group™ | Terms & Conditions