Boost Your Sales Through Business Term Loans

Home – Service Detail

Understanding MCA funding Costs and Charges

Quick way to attain working capital (up to a $1,000,000) to keep your business moving forward.

What is Business Term Loans?

Business term loans are a type of financing where a lender provides a lump sum of money to a business, which is then paid back over a specified period with interest. These loans are typically used for significant investments such as equipment purchases, expansion, or other long-term financial needs.

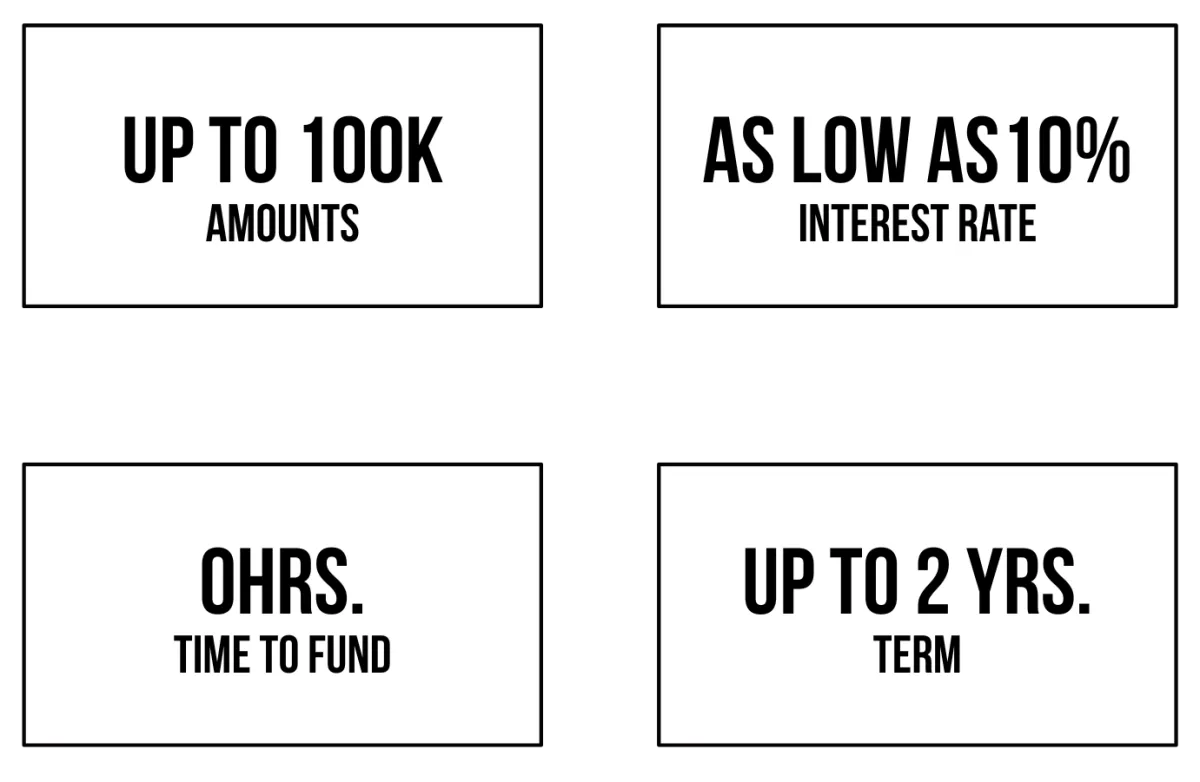

Key Features

Loan Amount: Term loans can vary widely in amount, often ranging from a few thousand to millions of dollars, depending on the lender and the business’s needs.

Repayment Terms: Repayment periods can range from a few months to several years. Short-term loans usually have terms of less than a year, while long-term loans can last five years or more.

Interest Rates: Interest rates depend on factors such as the borrower’s creditworthiness, loan amount, and term length. Rates can be fixed or variable.

Collateral: Many lenders require collateral, which can include business assets or personal guarantees, to secure the loan.

Why Exquisite Capital Group For fast equipment financing

Quick and Convenient Access to Capital:

Competitive Terms and Rates

Support for Business Growth

Expert Guidance and Customer Support

Types of Business Term Loans

Short-Term Loans: Generally meant for immediate financial needs, these short term loans typically have repayment periods of one year or less.

Medium-Term Loans: These loans are often repaid over one to three years and are suitable for financing equipment purchases or working capital.

Long-Term Loans: Best for major investments, long-term loans have repayment terms of three to ten years or more.

Considerations Before Applying

What you’ll need to do to qualify for a Business term loans:

Creditworthiness: Lenders will assess credit scores and financial history, so it’s essential for businesses to maintain good credit.

Business Plan: A solid business plan can help demonstrate how the loan will be used and how the business intends to repay it.

Comparison Shopping: It’s wise to compare offers from multiple lenders to find the best terms and interest rates.

Fees: Be aware of any additional fees associated with the loan, such as origination fees or early repayment penalties.

2 years in business

$100,000 in yearly revenue

620+ credit score

Documentation Needed For Business Term Loans

Basic Details About You and Your Business

Business Is in Good Standing

Bank Statements for Past 3 Months

Advantages of Business Term Loans

Predictable Payments: Fixed interest rates and structured repayment schedules make it easier for businesses to plan their finances.

Access to Large Sums: Term loans can provide substantial funding, which is ideal for significant business ventures.

Improved Cash Flow: By financing large purchases over time, businesses can preserve cash flow for other operational needs.

Business term loans can be an excellent way for companies to finance growth and investment opportunities. By understanding the features, types, and requirements of these loans, businesses can make informed decisions that align with their financial goals.

Copyrights 2025 | Exquisite Capital Group™ | Terms & Conditions